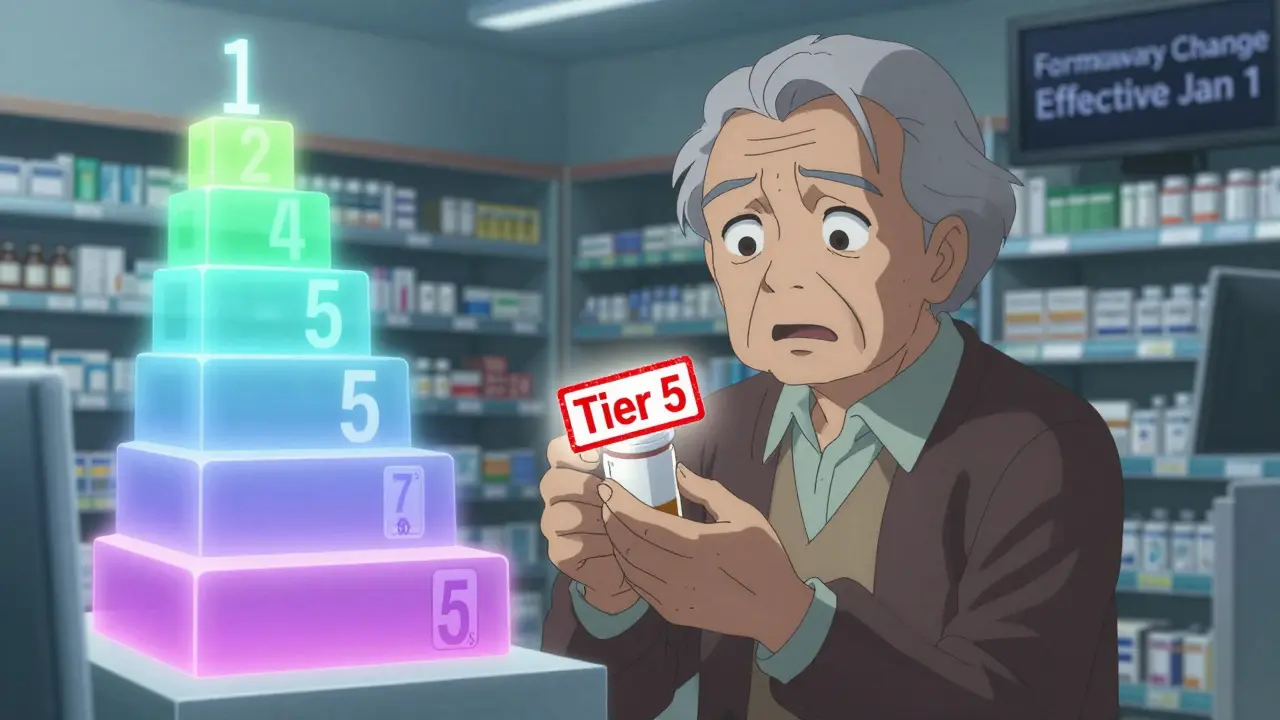

Every year, thousands of seniors in the U.S. face surprise hikes in their medication costs-not because prices went up, but because their insurance plan quietly moved their drug to a higher tier. If you're on Medicare Part D or a private plan with drug coverage, you need to know how to check your drug coverage tiers and spot formulary changes before they hit your wallet.

What Is a Drug Formulary and Why Does It Matter?

A drug formulary is simply the list of medications your insurance plan covers. But it’s not just a list-it’s organized into tiers, which determine how much you pay out of pocket. The higher the tier, the more you pay. Most plans use 3, 4, or 5 tiers:- Tier 1: Preferred generics-usually $0 to $10 per prescription.

- Tier 2: Non-preferred generics or lower-cost brand-name drugs-around $15 to $30.

- Tier 3: Higher-cost brand-name drugs-often $40 to $75.

- Tier 4: Non-preferred brand drugs or those with alternatives in lower tiers-$80+.

- Tier 5: Specialty drugs-like injectables or pills for cancer, MS, or weight loss. These can cost $100 to $500+ per month.

When Do Formulary Changes Happen?

Most plans update their formularies on January 1st each year. But changes can also happen mid-year. According to CMS guidelines, plans can change a drug’s tier or remove it entirely if:- A cheaper generic becomes available

- New safety concerns arise

- A new drug enters the market

- The manufacturer changes pricing or terms

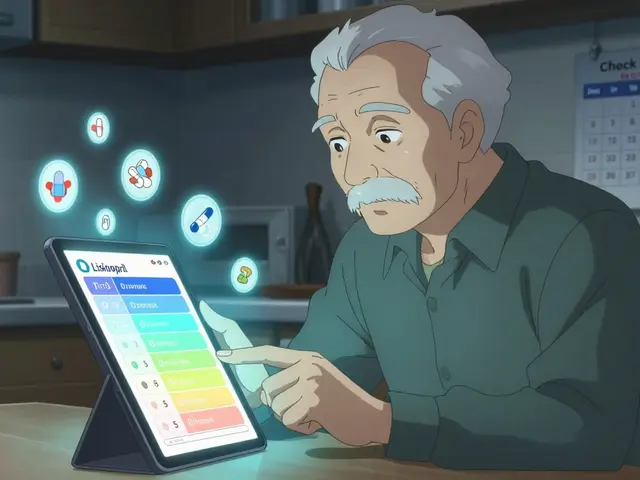

How to Check Your Drug’s Tier Right Now

You don’t need to wait for a notice. You can check your drug’s tier anytime. Step 1: Find your plan’s formulary tool.Go to your insurance provider’s website-Humana, Cigna, Excellus BCBS, UnitedHealthcare, or Medicare.gov if you’re on Part D. Look for “Drug Formulary,” “Formulary Search,” or “Find a Drug.” Step 2: Enter your medication name.

Type in the exact name, including the brand or generic version. For example, “lisinopril” (generic) vs. “Zestril” (brand). They may be in different tiers. Step 3: Look for the tier and cost.

The tool will show you:

- Which tier your drug is on

- Your copay or coinsurance amount

- Whether prior authorization is required

- If there are step therapy rules (you must try a cheaper drug first)

What to Do If Your Drug Moves to a Higher Tier

If your drug gets moved up, you have options. Option 1: Ask for an exception.You can request that your plan cover your drug at a lower tier if:

- It’s medically necessary

- Lower-tier alternatives don’t work for you

- You’ve had side effects with other drugs

Ask your pharmacist or doctor if there’s another drug in the same class that’s on a lower tier. For example:

- If your brand-name statin (Lipitor) moved to Tier 4, ask about generic atorvastatin (Tier 1).

- If your diabetes drug moved up, check if metformin or glimepiride is covered better.

Medicare Open Enrollment runs from October 15 to December 7 each year. If your plan’s formulary is getting worse, you can switch to a different Part D plan with better coverage for your meds.

How to Stay Ahead of Changes

Don’t wait for a bill or a pharmacy rejection. Be proactive.- Check your formulary every October. That’s when plans release their next year’s drug list.

- Sign up for email alerts. Most insurers send notifications when a drug you take changes tier.

- Call customer service. Ask: “Is my medication on the 2026 formulary? What tier?” Don’t rely on the website alone.

- Use SHIP. The State Health Insurance Assistance Program (SHIP) offers free, local counseling. In Minnesota, they helped over 25,000 seniors in 2023 with formulary questions.

- Keep a list. Write down your drugs, tiers, and copays. Update it every time you get a notice.

Common Mistakes Seniors Make

Many people assume their coverage stays the same year after year. It doesn’t. Here’s what trips people up:- Not checking until it’s too late. 42% of formulary-related calls to insurers happen when someone tries to refill a prescription and gets shocked by the price.

- Confusing brand and generic. Your plan may cover the generic but not the brand. Always ask which version you’re getting.

- Assuming all plans are the same. Two plans might have the same premium, but one covers your drug in Tier 1 and the other in Tier 4. The difference could be $300 a month.

- Not knowing about exceptions. Only 18% of seniors know they can request a formulary exception. Most think they’re stuck.

What’s Changing in 2025 and Beyond

CMS is pushing for simpler formularies. A pilot program starting in 2025 will standardize most plans around a 4-tier model to reduce confusion. That’s good news. But costs are still rising. By 2026, over half of the top-selling drugs will be classified as specialty medications-putting them in the highest, most expensive tier. Insurers are also rolling out AI tools to recommend lower-cost alternatives. In 2025, 78% of major plans will use these systems to suggest switches during online formulary searches. You might see a pop-up saying: “Your drug is $65. A similar one costs $12. Want to switch?” The goal? Lower costs. But the burden still falls on you to understand your plan and speak up.Final Advice: Don’t Guess. Check.

Medicare Part D covers 53.5 million people. Every one of them has a formulary. And every one of them can be affected by changes they didn’t see coming. The key isn’t knowing every rule. It’s knowing how to check. Do this now:- Go to your plan’s website.

- Search for your top 3 medications.

- Write down the tier and cost.

- Set a reminder for October 1st to check again.

How often do Medicare Part D formularies change?

Most Medicare Part D plans update their formularies once a year on January 1st. But changes can also happen mid-year if a drug’s safety changes, a cheaper generic becomes available, or a new drug is approved. By law, your plan must notify you in writing at least 60 days before a change affects a drug you’re taking-unless it’s due to a safety issue, in which case they can act faster.

Can I switch plans if my drug gets moved to a higher tier?

Yes, but only during specific times. You can switch Medicare Part D plans during the Annual Enrollment Period (October 15 to December 7) or during a Special Enrollment Period if you qualify-for example, if your drug is removed from the formulary or your plan loses its Medicare contract. Outside these windows, you’re stuck unless you successfully request a formulary exception.

What’s the difference between a copay and coinsurance?

A copay is a fixed amount you pay-for example, $10 for a Tier 1 drug. Coinsurance is a percentage of the drug’s total cost-for example, 30% of a $200 specialty drug, which would be $60. Most formularies use copays for lower tiers and coinsurance for higher tiers. Always check which one applies to your drug.

How do I know if my drug is a specialty medication?

Specialty medications are usually high-cost, complex drugs that require special handling-like injectables, infusions, or pills for cancer, MS, rheumatoid arthritis, or rare conditions. They’re almost always in Tier 5. If your drug costs over $670 per month (the 2025 threshold), it’s likely classified as specialty. Check your plan’s formulary tool-it will label these clearly.

What if my doctor says I need a drug that’s not on the formulary?

You can request a formulary exception. Your doctor must submit documentation showing why other covered drugs won’t work for you-due to side effects, allergies, or lack of effectiveness. If approved, your plan will cover the drug at a lower tier. If denied, you can appeal. About 68% of exceptions are approved when backed by strong medical evidence.

Can I use GoodRx if I have Medicare Part D?

Yes, but not at the same time. You can choose to use GoodRx instead of your insurance if the cash price is lower than your copay. However, GoodRx payments don’t count toward your Medicare Part D deductible or out-of-pocket maximum. Use it as a backup when your plan’s cost is too high, but don’t rely on it long-term for drugs you take daily.

Do all Medicare Part D plans have the same formularies?

No. Each plan designs its own formulary within CMS rules. While all must cover at least two drugs per therapeutic category, they can choose which ones and where to place them. That’s why the same drug can be Tier 1 on one plan and Tier 4 on another. Always compare formularies when choosing a plan.

How do I find my plan’s formulary if I don’t have internet access?

Call your plan’s customer service number (found on your ID card). They’re required to mail you a printed copy of the formulary at no cost. You can also visit your local SHIP office-Minnesota has over 60 locations that offer free help with formulary questions and can print materials for you.

Next Steps: Protect Your Medication Access

If you take one or more prescription drugs, do this today:- Write down your top 3 medications and their current copays.

- Go to your plan’s website and search each one.

- Call customer service if anything looks off.

- Set a calendar reminder for October 1, 2025, to check again.

Oh my god, I just checked my formulary and my insulin moved from Tier 1 to Tier 5. I thought I was safe because I’ve been on the same plan for five years. Turns out, they quietly reclassified it as a ‘specialty drug’-same pill, same dose, now I’m paying $420 a month. I cried in the pharmacy aisle. No one warned me. This post? Lifesaver. Thank you.

Man, I didn’t even know formularies changed yearly. I thought once you’re enrolled, it’s locked in. Good to know I gotta check every October like my phone updates. I’ll be doing this tomorrow-no more surprises at the counter.

They’re doing this on purpose. Big Pharma and the insurers are in cahoots. They push expensive drugs, then make you pay for them by moving generics to higher tiers. It’s a scam. They want you to switch to the new $500 weight loss drug so they can rake in the cash. Wake up, people.

I’ve been using GoodRx for my blood pressure med-it’s cheaper than my copay. But I didn’t realize it doesn’t count toward my out-of-pocket max. Kinda sucks, but at least I’m not broke this month. Still, I’ll check my formulary this week. Better safe than sorry.

When I first got on Medicare Part D, I assumed everything was set in stone. I didn’t realize how much power insurers had to shift costs onto us without warning. I had to fight for an exception for my antidepressant after it got moved to Tier 4-my doctor had to write a letter, I had to call three times, and it took six weeks. I’m not mad, I’m just… tired. This is the kind of thing that wears you down when you’re on a fixed income. Please, if you’re reading this, check your formulary. Don’t wait until you’re standing at the pharmacy counter with your heart in your throat.

Specialty tier = $670+ monthly threshold. That’s the new benchmark. And guess what? GLP-1s are being classified as ‘non-essential’ even when prescribed for diabetes. That’s not a formulary change-it’s a policy war. Insurers are gaming the system to avoid covering drugs that are too popular. We need regulatory intervention, not just ‘check your formulary’ advice.

So let me get this straight. You’re telling me I have to become a full-time insurance detective just to afford my meds? My grandma died because she couldn’t afford her heart meds after they moved them to Tier 4. And now you want me to ‘set a reminder for October’? That’s not advice-that’s a death sentence wrapped in a calendar notification. This system is broken. Someone needs to burn it down.

For everyone panicking about tier changes: You’re not powerless. Requesting an exception works way more often than people think-especially if your doctor writes a clear, specific letter. I’ve helped three friends get their drugs reinstated at lower tiers just by walking them through the form. And if your plan denies it? Appeal. The second appeal rate is over 70%. You have rights. Use them. Don’t let them gaslight you into thinking you’re stuck. Call your SHIP office. They’re free. They’re trained. They’ve seen it all. You don’t have to fight alone.

While your post is technically accurate, it’s dangerously oversimplified. The real issue isn’t formulary tiers-it’s the lack of price transparency and the absence of universal formulary standardization. By placing the burden on seniors to ‘check their formulary,’ you’re enabling systemic neglect. This isn’t a personal responsibility problem-it’s a policy failure. And GoodRx? It’s a Band-Aid on a hemorrhage. Until Congress caps drug prices and mandates formulary consistency, all this advice is just rearranging deck chairs on the Titanic.

Just checked my formulary-my metformin’s still Tier 1! 🙌 I set a reminder for October 1st. Also downloaded the SHIP app. Feels good to have a little control again. You’re not alone out there. We got this.

Oh so now I’m supposed to be a pharmacist, a lawyer, and a data analyst just to get my diabetes meds? Cool. I’ll just take my $300 monthly bill and turn it into a motivational poster. ‘I survived Medicare Part D.’ Next year’s theme: ‘I fought the formulary and the formulary won.’

Check your formulary. Call customer service. Use SHIP. Write down your meds. Do it now. Five minutes today saves $200 next month. Simple.