Every year, millions of seniors face unexpected spikes in their medication costs-not because their prescriptions changed, but because their insurance plan did. If you're on Medicare Part D or a private plan with a drug formulary, you're likely paying different amounts for the same drug depending on which tier it's in. And those tiers? They can shift without warning. Knowing how to check your drug coverage tiers and spot formulary changes isn’t just helpful-it’s essential to avoid surprise bills.

What Is a Drug Formulary and Why Does It Matter?

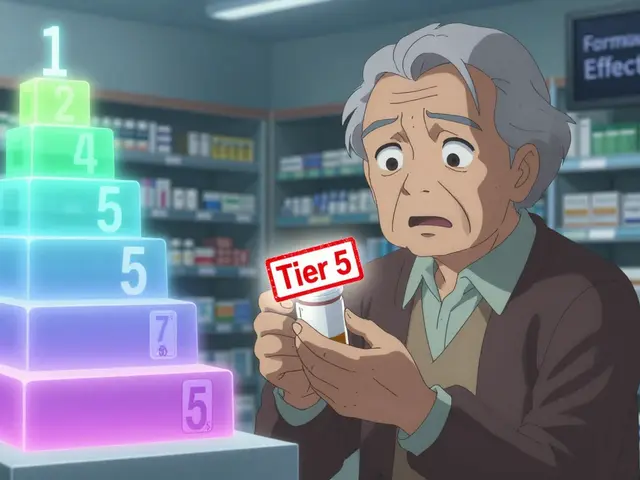

A drug formulary is simply the list of medications your insurance plan covers. But it’s not just a simple list. It’s broken into tiers, and each tier has a different cost to you. Tier 1 is usually the cheapest-often generic drugs with a $5 or $10 copay. Tier 5? That’s where specialty drugs like GLP-1 weight loss medications (Wegovy, Ozempic) land, with coinsurance that can hit $300 or more per month. The system was designed to save money for insurers, but it also pushes patients toward cheaper alternatives. The problem? Many seniors don’t realize their blood pressure pill or diabetes med moved from Tier 1 to Tier 3 overnight. One user on Medicare.gov reported their monthly cost jumped from $10 to $55 after a formulary update. That’s not a rare case.How Tiers Work: 3, 4, or 5 Levels?

Not all plans use the same structure. Most have either 3, 4, or 5 tiers. Here’s what you’re likely to see:- Tier 1: Preferred generics. Lowest cost. Often under $10.

- Tier 2: Non-preferred generics or lower-cost brand-name drugs. Around $15-$30.

- Tier 3: Higher-cost brand-name drugs. No generic available yet. Can be $50-$100.

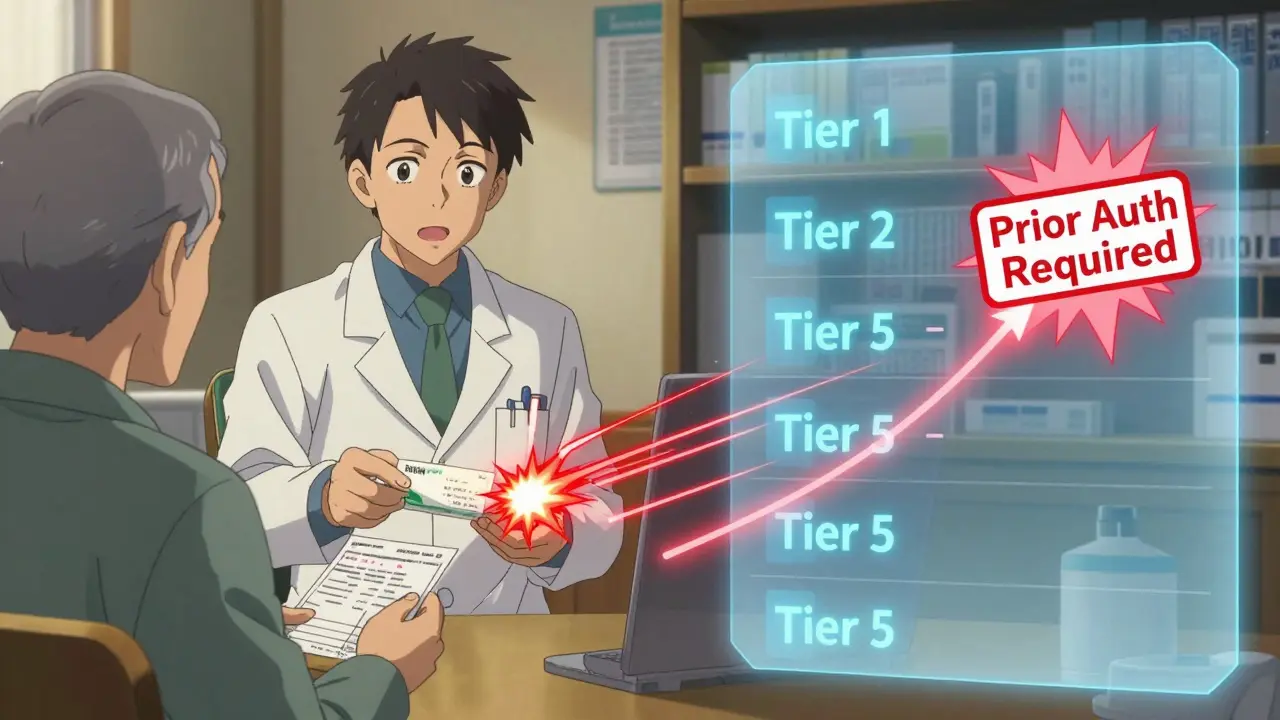

- Tier 4: Non-preferred brand-name drugs with alternatives in lower tiers. Often require prior authorization.

- Tier 5: Specialty drugs. Injectables, infusions, or high-cost treatments. Coinsurance can be 33% or more of the total price.

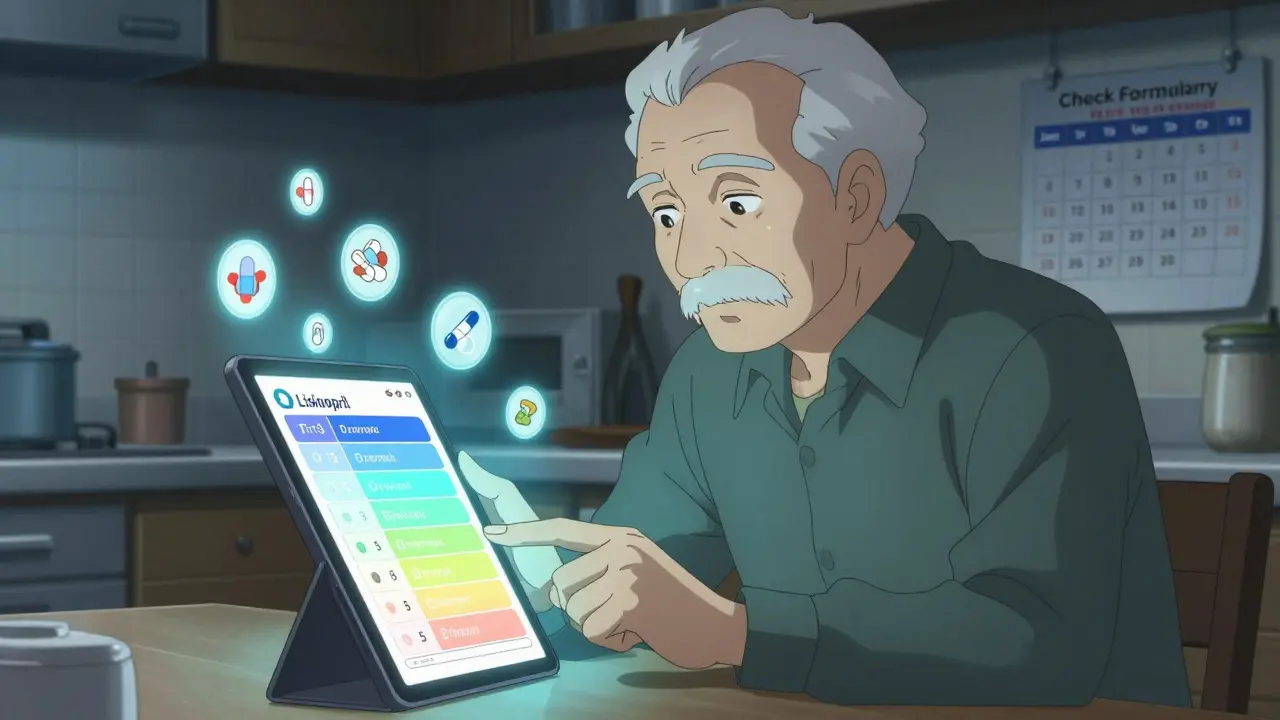

How to Check Your Drug’s Tier Right Now

You don’t need to wait for a letter. Here’s how to check your coverage in under 10 minutes:- Find your plan’s official website. Look for “Drug Formulary,” “Formulary Search,” or “Prescription Drug List.”

- Use the search tool. Type in your exact medication name-brand or generic. Don’t guess. If you take Lisinopril, search for that, not “blood pressure pill.”

- Check the tier. It will say something like “Tier 2” or “Preferred Brand.”

- Look at the cost. It should show your copay or coinsurance amount.

- See if prior authorization or step therapy is required. If it says “Requires Prior Auth,” your doctor must submit paperwork before the plan pays.

When Formularies Change (And How You’ll Know)

Plans can change their formularies anytime-but there are rules. By law, they must notify you if they:- Remove a drug completely

- Move your drug to a higher tier

- Add a new requirement like prior authorization

What to Do If Your Drug Gets Moved to a Higher Tier

Don’t panic. You have options:- Ask your doctor for a generic alternative. If there’s a cheaper version on Tier 1, they can switch you. Many drugs have multiple generics.

- Request a formulary exception. You can ask your plan to cover your drug at a lower tier if it’s medically necessary. Your doctor fills out a form. Approval rates range from 55% to 82%, depending on your plan and evidence provided.

- Use a 30-day transition supply. If your drug is being removed or tiered up, most plans must give you a 30-day supply while you and your doctor figure out next steps.

- Call your pharmacist. They know what’s covered and can suggest alternatives you might not know about.

How to Stay Ahead of Changes

Formularies aren’t static. They change every January-and sometimes mid-year. Here’s how to avoid getting caught off guard:- Check your formulary every January when new plans start.

- Set a calendar reminder to review your drugs every 3 months.

- Sign up for plan notifications via email or text. Most insurers let you opt in.

- Keep a printed or digital list of your drugs and their current tiers.

- Use free help: Your State Health Insurance Assistance Program (SHIP) offers free, one-on-one counseling. They helped 1.7 million people in 2022.

Common Mistakes Seniors Make

Most people don’t realize how easy it is to overpay:- Assuming your drug is still covered the same way after plan renewal.

- Not checking if your pharmacy is in-network. Even if the drug is covered, you might pay more at an out-of-network pharmacy.

- Ignoring prior authorization. If your plan requires it and you don’t get approval, you’ll pay full price.

- Not knowing the difference between copay and coinsurance. Copay is a fixed fee. Coinsurance is a percentage of the drug’s total cost. For a $1,000 specialty drug, 30% coinsurance = $300.

When to Switch Plans

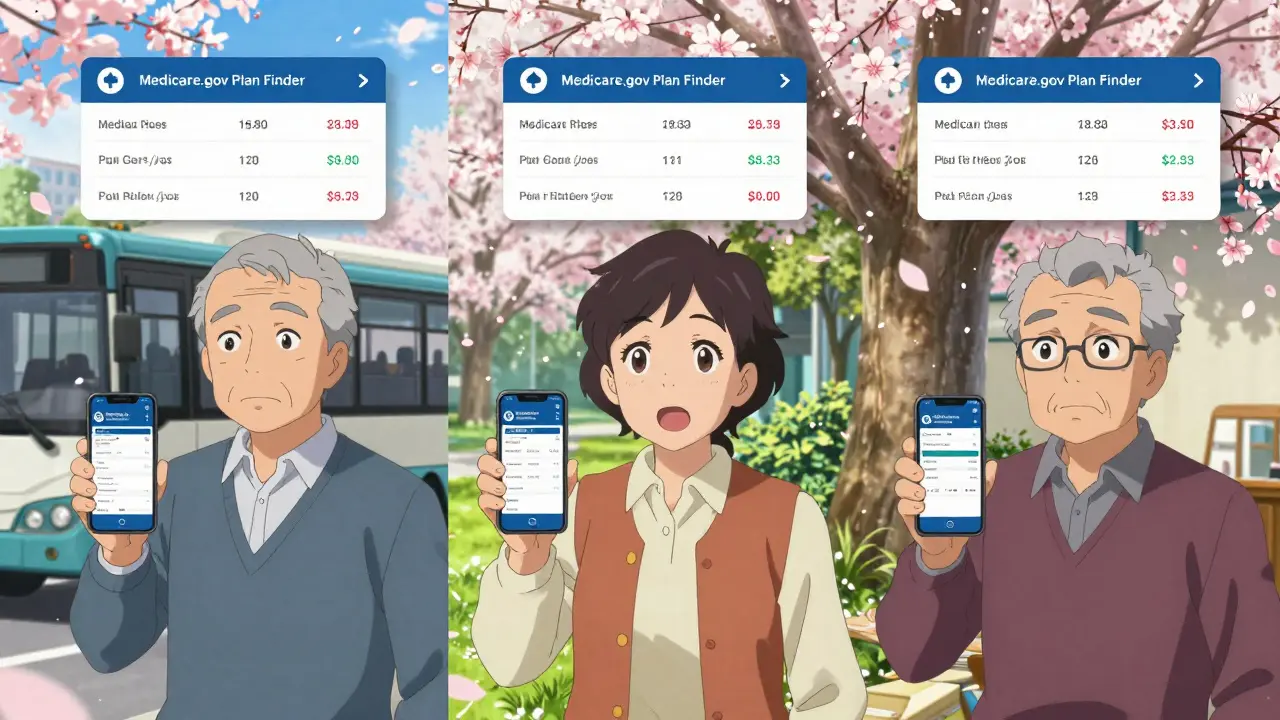

If your top 3 medications moved to higher tiers and you can’t get exceptions, it’s time to switch. Medicare’s Annual Enrollment Period runs from October 15 to December 7. You can switch plans to one that covers your drugs better. Use the Medicare Plan Finder tool to compare costs across plans. Look at the total yearly cost-not just the monthly premium. A plan with a $40 premium but $200 monthly drug costs might be worse than a $100 premium plan with $20 drug costs.Final Tip: Don’t Wait for the Letter

Insurance companies aren’t required to call you. They send letters. But if you’re not checking your formulary, you won’t know the letter came. And if you miss the 60-day window, you might be stuck paying more for months. Check your plan’s formulary now. Do it before your next refill. It takes 5 minutes. It could save you hundreds.How often do Medicare Part D formularies change?

Medicare Part D formularies are updated annually on January 1, but changes can happen mid-year too. Plans must notify you at least 60 days in advance if they remove a drug, move it to a higher tier, or add a new restriction-unless it’s for safety reasons, like a drug recall. Always check your formulary in January and every 3 months after.

Can I get my drug covered if it’s not on the formulary?

Yes. You can request a formulary exception. Your doctor must submit a letter explaining why you need that specific drug-usually because alternatives didn’t work or caused side effects. Approval rates range from 55% to 82%, depending on your plan and medical evidence. Don’t assume you’re out of luck-many requests are approved.

Why is my generic drug now more expensive?

Sometimes, a newer generic version becomes available, and your plan switches to that one as the preferred option. Your old generic may be moved to a higher tier or dropped entirely. Even though both are generics, one is considered “preferred” and the other isn’t. Always check if your exact brand of generic is still covered at the lowest cost.

What’s the difference between a copay and coinsurance?

A copay is a fixed amount you pay-like $10-for a drug. Coinsurance is a percentage of the drug’s total cost. For example, if your drug costs $500 and your coinsurance is 25%, you pay $125. Specialty drugs (Tier 5) almost always use coinsurance, which can make costs unpredictable. Always check which one applies to your drug.

Do all Medicare Part D plans have the same formulary?

No. Two plans can cover the same drug but put it in different tiers. For example, Lisinopril might be Tier 1 on Plan A and Tier 2 on Plan B. That’s why comparing plans using the Medicare.gov Plan Finder is critical when choosing or switching plans. The same drug can cost $10 more per month just because of tier placement.

Can my pharmacist help me with formulary questions?

Yes. Pharmacists are trained to know which drugs are covered under which tiers and can often suggest cheaper alternatives that are clinically similar. They can also tell you if your drug requires prior authorization or if a 30-day transition supply is available. Don’t hesitate to ask them before you fill a prescription.

Man, I didn’t even know tiers changed mid-year until my insulin jumped from $12 to $89. Took me three calls and a letter from my doc to get it reversed. Don’t wait for the mail-check your plan like it’s your Netflix subscription.

They’re doing this on purpose. Big Pharma and the insurers? They want you confused so you just pay up. I’ve seen people on GLP-1s get kicked off their meds because some bean counter decided it’s ‘not cost-effective.’ Wake up, people-this isn’t healthcare, it’s a profit game.

I used to just trust my pharmacy. Then I started checking the formulary every January. Now I keep a spreadsheet. It’s weird, I know. But $200/month saved is worth a few minutes. I’m not a nerd-I’m just not broke.

Formulary tier shifts are the silent tax on aging. You think you’re covered, then bam-your metformin’s now Tier 3 because some generic with the same active ingredient got pushed to Tier 1. The system doesn’t care if your body reacts to the ‘preferred’ version. It’s all about the rebate.

Let me break this down for anyone still confused: if your drug’s tier changes, your first move is NOT to panic. It’s to call your pharmacist. They know which generics are interchangeable, which ones are not, and whether your plan has a transition supply. I’ve helped three seniors avoid $300+ bills just by asking, ‘What’s the cheapest version that works?’ And yes-it’s almost always a generic. You don’t need a new script. Just a little hustle. Also, SHIP counselors are free. Use them. They’re not telemarketers. They’re lifesavers.

Oh honey, I remember when my blood pressure med went from $5 to $67 overnight. I thought I’d been robbed. Turns out, the plan switched from the old generic to a newer one-and I didn’t realize they were technically different pills even though they had the same name. I cried in the pharmacy aisle. Then I called my SHIP counselor, who said, ‘Try the other generic, it’s still Tier 1.’ She was right. Saved me $700 a year. So yes, check your formulary. But also, please, please, talk to someone who’s been through it. You’re not alone. And no, you don’t have to be a bureaucrat to survive this system. Just be curious. And maybe keep a notebook. I color-code mine now. Pink for expensive, green for ‘still affordable.’

This is why I hate Medicare. They don’t care if you’re dying. They care if the drug’s on the rebate list. My mom got kicked off her heart med because a cheaper version came out-even though it gave her migraines. The plan didn’t care. The doctor said ‘no alternative,’ but they still denied the exception. They’re not here to help you. They’re here to make money. And if you’re not fighting, you’re paying.

The notion that formulary changes require 60-day notice is misleading. The regulation applies only to non-safety-related changes. In practice, insurers routinely exploit loopholes-especially with new generics-by reclassifying existing brands as ‘non-preferred’ without formal notification. Furthermore, the Medicare Plan Finder tool is notoriously inaccurate for specialty drugs due to pharmacy network variances. Relying on it as a primary tool is financially reckless. You must cross-reference with your insurer’s direct formulary PDF, which is often buried in a PDF archive under ‘Annual Benefit Changes.’

I read this and thought, ‘Thank god I’m not alone.’ My husband’s diabetes med went from $15 to $110 last year. We didn’t know until the pharmacy said, ‘You owe $300.’ We had to fight for six weeks to get a formulary exception. I spent nights writing letters, calling doctors, crying in the car. But here’s the thing-I didn’t know any of this until I started reading forums like this. So if you’re reading this and you’re scared? You’re not broken. The system is. But you can fight it. Ask for the exception. Talk to your pharmacist. Use SHIP. Write down every step. And if you feel powerless? You’re not. You just haven’t found your voice yet. I didn’t either-until I started talking. And now I help other people do the same. You’ve got this.